How Convosphere's netnographies informed Mapfre's targeted content marketing creation

This post by Eva Velasco, Head of Research and Social Media Analysis at MAPFRE, and Tamara Lucas, Associate Director at Convosphere, explains how one of the top insurance companies in Spain used Digital Customer Insights to inform content creation and development in marketing campaign planning.

Eva Velasco and Tamara Lucas will walk through:

1. How audience fragmentation necessitates the use of various data points to understand their behaviours, interests and personalities.

2. How matching audience insights with real social conversation helps to inform bespoke messages that drive action.

3. How using netnography can help drive content engagement and higher brand message saliency.

Model shift: From broadcast to engagement

(Eva Velasco) Before starting this project, I felt that we were bombarding our customers with generic, non-targeted content, assuming we knew what all of our customers liked and were searching for. In large companies, such as MAPFRE, large budgets are invested in campaigns, with the hope to reach and engage potential customers.

But the broadcasting model isn’t working anymore. Customers want to be in the centre, they want to be treated as unique entities and engage with the brand on their own terms. So, I realised that in order to improve customer experience, we first had to improve our knowledge of the customer.

MAPFRE is a global insurance company with a worldwide presence. It is the benchmark insurer in the Spanish market and the largest Spanish multinational insurance group in the world. The company is the third-largest insurance group in Latin America and the sixth in Europe by Non-Life premium volume.

As you may imagine, my role as a Head of Research and Social Media Analysis comes with plenty of challenges. It takes time to change things that have been done in a certain way for many years. This project served as the starting point to implement a new methodology for content marketing creation; not solely data-driven, but informed by data.

The hypothesis tested: By analysing the conversations of our target audience as well as their personalities, interests and online behaviours, we expect to create campaigns that were more efficient and personalised to each segment of the target audience.

The process: Qualitative analysis assisted by technology

(Tamara Lucas) As a first step, we defined the universe of people MAPFRE wanted to understand: Millennials (aged 25-35) in Pennsylvania, United States. Next, we focused on analysing the significant milestones in the lives of this audience (for example life milestones, such as getting married, buying a house or becoming a parent).

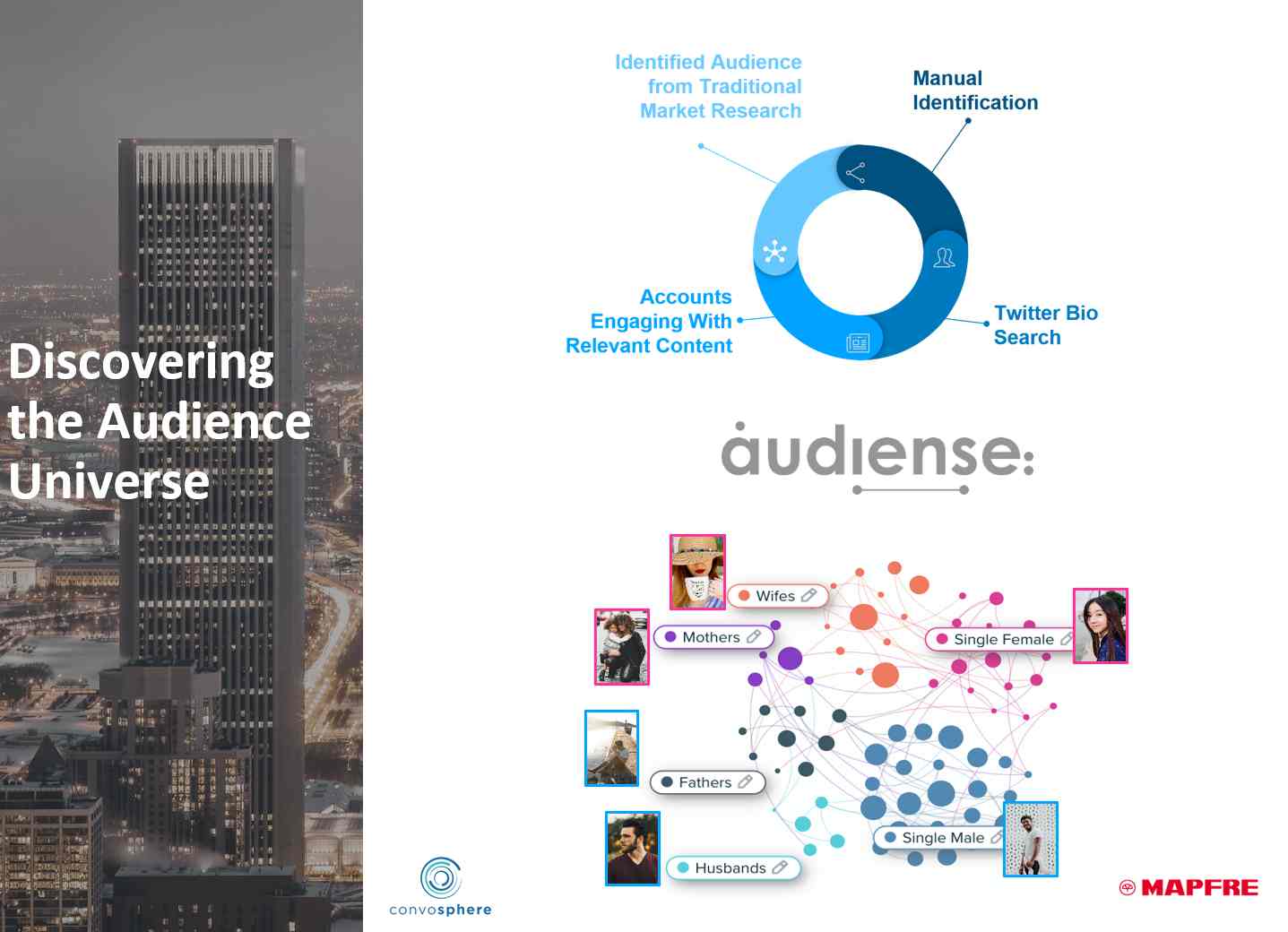

We used a tool called Audiense to identify audience segments based on gender and marital status as specified in the bio of their Twitter profile. We identified six customer segments: single men, married men, fathers, single women, married women and mothers.

Once the users in each group had been identified and manually reviewed, we used Brandwatch to monitor their conversations over the last six months. This helped us to clean each segment, for example removing the “parents” of dogs and cats, and moving people from single to the other two stages (parents, married) based on the information available.

Given the wide range of conversations, we then identified the topics that were of most interest and relevance to MAPFRE's objectives, such as conversations about entertainment, health and well-being, major life events (marriage, graduation, starting/looking for a new job etc.) and key financial decisions.

We profiled each audience group based on their unique personality traits, needs, and values that defined their personality. This information was enhanced with data on their online behaviours and consumption, for example, preferred content formats, the best times to reach them online, and the factors that influence purchasing decisions.

By cross-analysing personalities, user profiles, and conversations, we were able to determine the most relevant products and message types for each audience persona, giving specific recommendations for future marketing content-driven creation.

Running a data-informed campaign

(Eva Velasco) As Tami mentioned, combining personality, behaviour, and declared information gave the content more context about unique personality traits, needs, and values.

The content marketing development team created multiple so-called creativities to resonate with each cluster’s distinctive personality and interests. The creativities showed different messages and images that resonated with the type of content, interest, and personality observed during the target analysis phase.

Each creative was tested against a non-personalised piece of content to measure improvement and uplifts in engagement and content conversion rates.

After three months of testing the different versions of the personalised and non-personalised ads, we arrived at three key takeaways:

1. Posting personalised messages and segmenting audiences drove higher customer engagement on average on Facebook. On Twitter, the creative with the highest customer engagement rate was one of the personalised ones.

2. Branding campaigns have a positive impact on the performance phase and improved click-through rates (CTRs).

How are these findings informing next content creation and analysis steps?

We will continue using personalised customer messaging on niche audiences to drive customer engagement and brand awareness, especially on Facebook.

We will keep defining messages per niche audience types based on their interest in every stage of their journey.

Have you ever run a netnography analysis? What were your results? We would love to hear your experiences, find us in The Social Intelligence Directory.

About Eva Velasco and MAPFRE

Eva Velasco is the Head of Social Media Research and Social Media Analysis at MAPFRE. MAPFRE is a global insurance company with a worldwide presence. It is the benchmark insurer in the Spanish market and the largest Spanish multinational insurance group in the world.

This interview was recorded via LinkedIn Live, if you prefer to view on LinkedIn, click the button below.

View InterviewSee related content