Asking the Right Questions to Glean the Best Consumer Insights

With nearly 70 percent of the UK population active on social media, marketers understand the merits of digital consumer insights as a cornerstone of modern market research. But recognizing the opportunity DCI presents and extracting the right insights are two different things.

As researchers and analysts, we often find ourselves having to help partners overcome the reliance on a single dashboard to answer complex and nuanced questions from internal stakeholders. With dozens of social listening tools posing as the ultimate source of DCI, extracting meaningful insights from the vast digital landscape can be overwhelming.

Over the past ten years, Storyful has honed the skill of analyzing and contextualizing social media conversations. We pair proprietary and third-party tools with the unique logic and critical thinking that comes with quality, human analysis.

Here’s a quick guide designed to help you ask the right questions and build consensus with all the relevant stakeholders on a project.

The Human Lens Meets the Tools of the Trade

The different social listening dashboards you’re subscribed to can provide powerful cues about sentiment and engagement, but are limited in their ability to answer questions about why consumers behave the way they do. No single dashboard can reveal all the actionable insights about the organic conversations unfolding on social media every day.

You have to be willing to be tool-agnostic to investigate the questions at hand, applying a human lens to your analysis. Failing to apply human context to social media conversations leaves a tremendous amount of unmined social media intelligence on the table.

By posing the right questions before querying tools and platforms, brands can better unlock insights embedded in the complex patterns and innate emotion to digital conversations.

Narrow the Scope

The volume of social media conversations around any given topic is daunting and laden with social “noise.” To gain the highest quality of DCI, you need to start broader and whittle down to the very specific. Try asking what the goal of their research is and what audience segment they’re trying to learn more about. Are you a consumer products company looking to drive affinity and preference for your personal care line? Are you an airline setting out to understand why consumers are flying to certain parts of the globe less frequently? Narrowing down the scope of your research to very specific asks about products or behaviors is a far more effective approach than broad, unfocused questions such as “what are some trends in personal care and air travel in the UK?”

Narrowing down your scope of research will help you gain more effective and actionable DCI.

Challenge Assumptions

The next consideration is how your brand plans to use the outcome of your social media analysis. Clients often approach Storyful because they think they have an issue or industry at large that they want to understand. A part of our approach involves refining what that issue actually is and what they are going to do with the information once they have it. This step helps clients sharpen their own ideas and their expectations from the research.

Building a Comprehensive Toolkit

There is no one-size-fits-all approach to DCI. Even the age old question of quant versus qual will be shaped by the research need. For example, an audience landscape research report informing campaign strategy will likely use a lot more qualitative data than an ongoing monitoring report.

That’s why Storyful recommends tapping a suite of tools. While budget, team size and skills are all important considerations, there are typically three main categories of tools at your disposal.

Social listening tools

Open source tools (e.g. GDELT)

Manual research toolset (e.g. Advanced Twitter searches)

These tools differ and provide varying levels of detail at varying speeds. Using just one of these categories makes it challenging to paint an accurate, comprehensive understanding of social conversation. In a recent piece, our colleague Jeff Perkins detailed why social listening tools alone are not enough. A combination of tools--with a layer of human analysis--are pivotal to gleaning the best consumer insights.

Align Research to the Goal

Are you looking to inform your influencer marketing teams about the voices influencing the personal care purchases Gen Zs are making? Are you tapping DCI to provide your public relations and crisis response teams with a strategy for an upcoming product release? The tactical versus strategic usage of a DCI report, as well as the amount of detail that goes into it, could vary hugely depending on its end point.

Ultimately, deciding the parameters of an audience will decide the breadth and depth of your dataset, and your approach to querying that data. Deciding the parameters of an audience or topic and determining how the information will be used - whether to inform positioning, ad copy, crisis monitoring or audience insights will inform how your team extracts the most relevant insights.

Contact Fiona Thornton via email or LinkedIn to learn more!

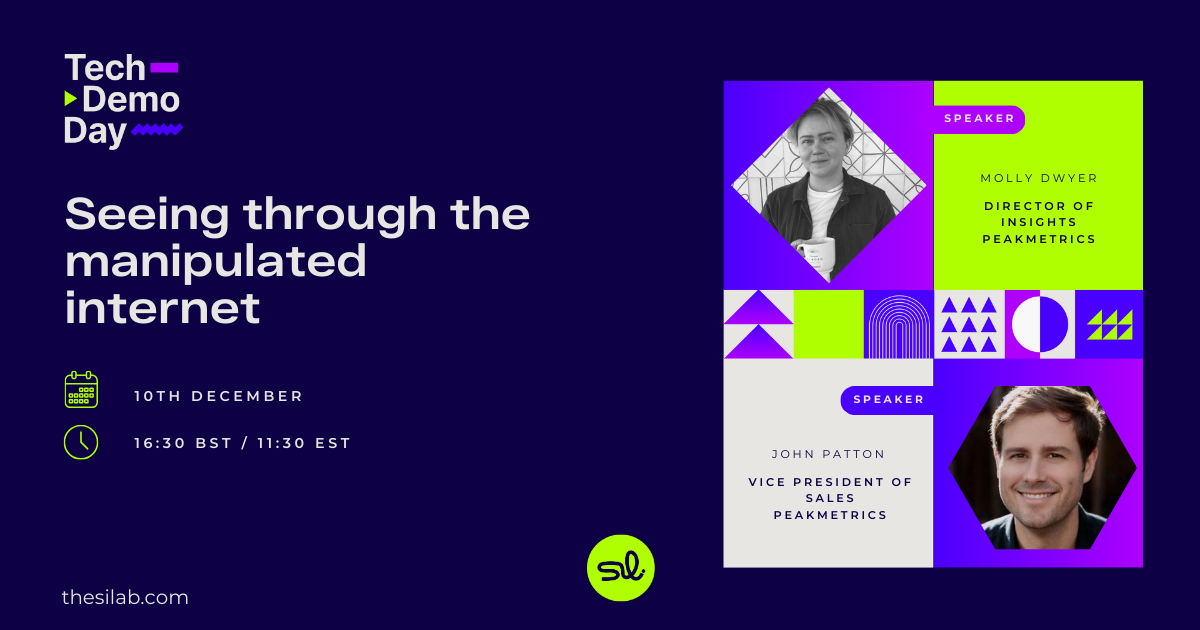

This interview was recorded via LinkedIn Live, if you prefer to view on LinkedIn, click the button below.

View InterviewSee related content